Bridging the Gap Between Transparency and Action: SWISOX & BX Launches Tradeable Green List

One of the biggest challenges in sustainable finance isn’t lack of data.

It’s what happens next.

Investors can now scroll through thousands of ESG scores, taxonomy disclosures, and sustainability claims — but still find themselves asking: Can I act on this? Can I actually invest in what I believe in?

This week, we’re proud to answer that question more directly.

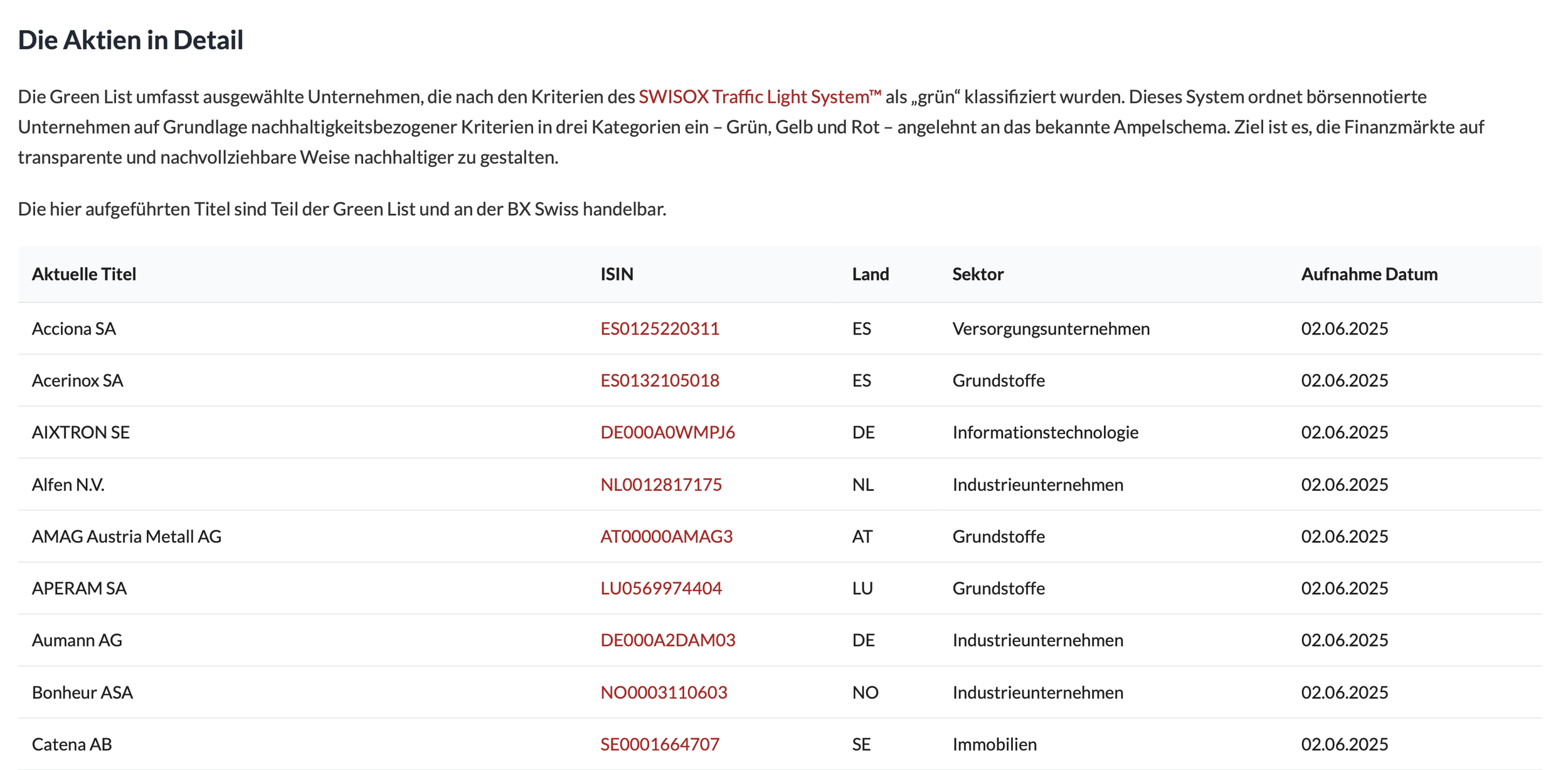

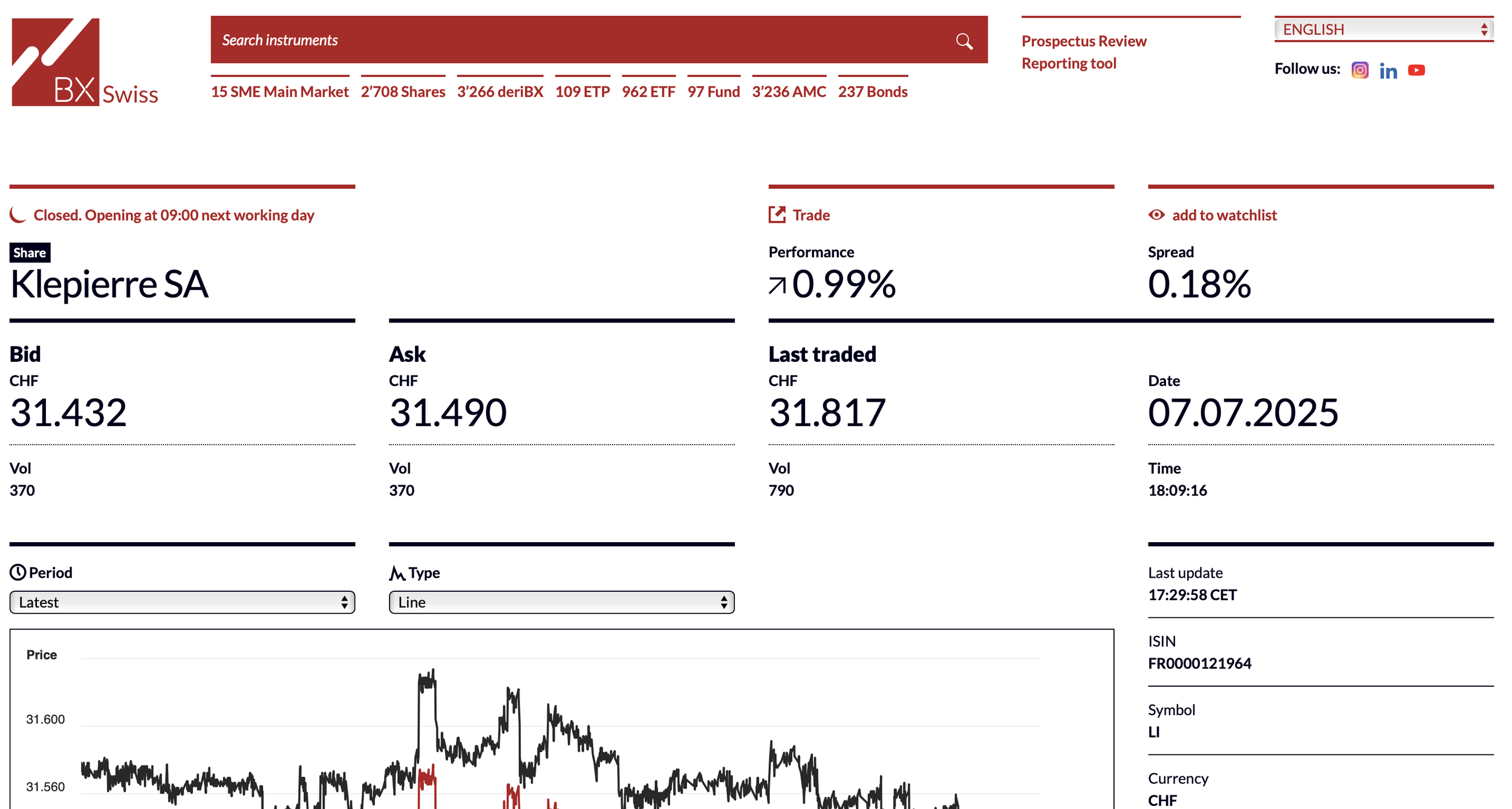

Together with BX Swiss — a Swiss stock exchange and home to our sister company BX Digital — 39 of the 70 companies on the SWISOX Green Light List are now tradeable directly in CHF.

It’s a milestone that turns classification into market access.

And it’s a clear signal of what comes next for sustainable finance.

Why we’re working with exchanges

At SWISOX, we’re building infrastructure for the next generation of climate-aligned capital — and exchanges are a critical piece of that architecture.

Stock exchanges are more than just trading venues. They’re gatekeepers of trust, translators of regulation, and increasingly, public platforms for economic signalling. If we want climate action to scale, then sustainable companies need to be visible, accessible, and investable within the same financial system that built the old economy.

That doesn’t mean retrofitting ESG labels onto traditional exchanges.

It means working with them to carve out new spaces — and new standards — where sustainability isn’t a marketing filter but a listing foundation.

This is what the BX integration helps demonstrate:

A functional, credible connection between company-level sustainability data and investor action.

What the launch means

Direct tradeability in CHF: Investors — retail or institutional — can now invest in Green Light companies using Swiss francs on the BX platform (retail customers will still need to use brokerage to do so)

Independent eligibility: Every company on the list has met strict sustainability criteria, including 55%+ taxonomy-aligned revenue, exclusion of fossil expansion, and (where available) limited assurance.

Real visibility for sustainable leaders: This integration elevates companies that are often overlooked in ESG benchmarks but meet the highest scientific thresholds.

No fossil development, no shortcuts: Companies flagged on Urgewald’s GCEL or GOGEL are automatically excluded — even if they’re 70% aligned or score well on other ESG indicators.

Explore the portfolio here:

Building the connective tissue of the marketplace

We often talk about sustainable finance in abstract terms: flows, frameworks, disclosures.

But if you zoom out, what really matters is the connective tissue — the infrastructure that makes sustainability credible and actionable. That means linking:

Classification → Listing

Data → Trading

Trust → Access

This BX collaboration is one of those links — small, but foundational.

It shows that climate-aligned investing doesn’t need to wait for new laws or new funds. It can be built on existing infrastructure, by upgrading how we classify, verify, and connect.

Want to invest with confidence in credible green companies?

🟢 Explore the Traffic Light System: Link

📊 Browse the tradeable list on BX: https://bxplus.ch/swisox-green-light-list/

📬 Subscribe to SWISOX Insights for more market updates and analysis.